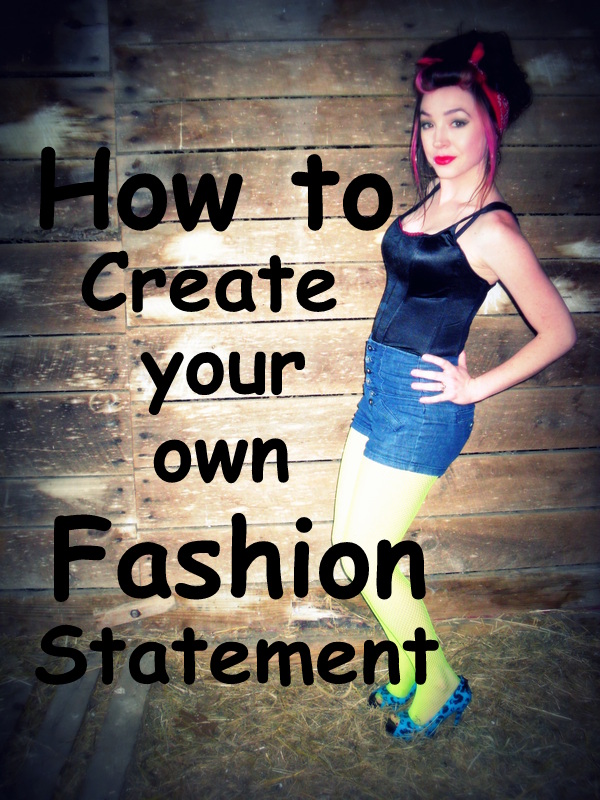

- This beautiful dress was in the Clearance Section (yes, my thrift store has a clearance section! How great is that?!!) of my local thrift store. In the clearance section everything is only $.50! I don't usually find anything in the clearance section, it's usually ugly clothes that no one wants. But that day, I found this! I am obsessed with Peter Pan Collars on dresses, and while I don't think this is exactly a Peter Pan collar, it's close enough! I pulled this off the rack and my mom and husband were both like, "Yes, that is so you, you need to get it!"

It's from Charlotte Russe.

I have been searching for a pair of summer wedges since last summer when I broke my espadrilles, and whilst I was browsing the shoe rack for a "new" pair of work shoes, I found these! They were exactly my size (what are the odds!) and were only $2.00! Too perfect!

They are Montego Bay Club.

-The anklet

I got this anklet in the Dominican Republic. The guy gave it to me for free! He also gave my husband a free necklace (I think he was doing it in hopes that we would buy some of his souvenirs he was selling, which we did, haha)!

Have a wonderful week all you wonderful people!!!

Peace Love and Thrift Store Ootw

Jess <3